-

Our clients were incredibly engaged, rewarding us with deeper relationships and still higher net promoter and satisfaction scores, even as service deteriorated at many of our competitors as they struggled to fill positions and keep clients satisfied.

- Average net promoter score of 73.3% across all markets measured by Coalition Greenwich.

- Average Overall Satisfaction of 77% across all markets measured by Coalition Greenwich.

-

And our shareholders were enriched by top-quartile returns largely driven by impressive growth in loans, deposits, fees, earnings and tangible book value per share.

- Common share price: $95.50 at Dec. 31, 2021 – 48.3% growth YoY

- Diluted EPS: $6.75 – 67.5% growth YoY

- Loans: $23.0 billion – 11.7% annual growth (excluding PPP loans)

- Core deposits: $29.3 billion – 24.7% annual growth

- Non-interest income: $395.0 million – 24.7% growth YoY

- Tangible book value per common share: $42.55 – 14.2% growth YoY

The pace of growth across all of those metrics may surprise some. But we believe difficult operating environments only serve to showcase the competitive advantage we can offer to associates, clients and shareholders. They give us a platform to flex the power of our culture, our service experience and the consistency of our shareholder returns.

As the challenges from 2020 lingered throughout 2021, never was the power of our culture more evident.

"As the challenges from 2020 lingered throughout 2021, never was the power of our culture more evident."

While many are experiencing a “Great Resignation,” we attracted new associates from vulnerable competitors at a record pace, driving growth, and we retained roughly 94 percent of our existing associates, making that growth sustainable.

While many companies battled against accelerating declines in service quality thanks to concurrent crises, we continued to top our markets in many of the service metrics that define client loyalty and advocacy.

And while economic uncertainty has tested many areas of the market and at times made the Fed’s response difficult to predict, Pinnacle’s share price set records and hit a significant milestone in the face of headwinds for the banking industry as a whole.

That combination of rapid organic growth, baked-in sustainability and a track record for performance is the Pinnacle story in a nutshell, all thanks to two crucial beliefs:

- People matter. They built our company and fuel its rapid growth.

- “Culture eats strategy for lunch.” It makes our growth sustainable—even in difficult times—by fostering deep loyalty in our existing associates and clients, as well as attracting more,even in a fiercely competitive environment.

Since 2000, we have made significant, consistent and long-term investments in both people and culture, leading to more than two decades of rapid, reliable and sustainable growth.

And just as it did following crises in 2001 and 2008, we believe the performance of our associates and our firm in 2021 proves that Pinnacle is poised to continue and accelerate that trend going forward.

"Since 2000, we have made significant, consistent and long-term investments in both people and culture, leading to more than two decades of rapid, reliable and sustainable growth."

The new normal for work and service relationships

For many, 2021 was a year of slow and tiresome implementation of changes made in reaction to the crises that arose in 2020. Suddenly more and more companies realized how much their people matter and how treating them poorly can quickly turn an upward trajectory into a race to the bottom.

Depending on which poll you look at, anywhere from half to two-thirds of all American workers are thinking of changing jobs or actively looking for a career change. Employees everywhere have realized they can quit their jobs at any time and go almost wherever they like, or they can choose to take a break from work, with money often a secondary concern instead of the primary driver.

That’s bad news for many banks, where clients are more loyal to people than to bank logos. But at Pinnacle, we are not only ready but eager to capitalize on that power shift. We’ve been prepared for it since Day 1 because we have always believed that a happy and successful workforce, and a bank’s ability to attract and keep them, is the difference between growth and contraction, between investment in the future and austerity.

All workers expect more of their employers. Customers, particularly in financial services, are maybe more frustrated than ever with poor service at a time when they have an increasing number of options for new providers.

According to Coalition Greenwich, overall satisfaction scores at America’s top 10 banks for both small and mid-size businesses have averaged less than 50 percent over the last three years. To us, that means clients are just as likely to leave as they are to stay, which is a poor reflection on our nation’s most powerful financial institutions.

For Pinnacle, it means compounding opportunities to move bankers and business away from these firms.

While the world’s circumstances have changed a lot since we opened our doors, we have always been driven by a belief that workers want and deserve more from their jobs, and customers won’t stand for poor service when they have an increasing number of options.

Put another way, everyone deserves a great place to work and a great place to do business. That’s never been truer than it is right now, and in fact we believe everyone expects a great place to work and will accept nothing less than a great place to do business.

"Everyone expects a great place to work and will accept nothing less than a great place to do business."

That belief has made us one of the strongest banking franchises in the United States.

- Q4

- Q3

- Q2

- Q1

For a reconciliation of non-GAAP financial measures to their most directly comparable GAAP measures, see Business Insights.

Because Pinnacle was prepared for this moment. We’ve always put our associates front and center and sought to WOW our clients. We saw the declines in work environment and service quality 22 years ago and knew they would eventually reach a tipping point.

Investing in people and culture

In our view, rapid and sustainable growth is the primary ingredient for producing outsized shareholder returns.

If attracting top performing people is the primary driver for rapid growth, and creating a best-in-class culture is the way to make it sustainable, then nothing can be more important than investing in both—especially now.

The fundamental thrust for why people work and how they choose their employer has changed, and the companies that can meet these needs will enjoy continued growth.

The drivers are no longer just a matter of paychecks and perks, although that may be what brings some to the door. Now more than ever, companies have to invest in balance, flexibility, care, compassion and purpose to keep their associates happy.

Balance and flexibility aren’t that difficult to achieve anymore. Hybrid work and creative scheduling became the norm in 2020, primarily in response to the pandemic. So care, compassion and purpose appear to be the holy grail of associate engagement and retention. They speak directly to culture, which is something that can’t be easily fixed by throwing resources at it.

Culture has to be part of the foundation and nurtured deliberately over time. If it’s not authentic, baked into everything a company does, and if it’s not permanent, aimed at the long term, it just doesn’t work, and people will leave.

This is why we are so focused on our work environment, our culture and our associates above all else, why our investments in them are not just acceptable but strategically critical. Few banks would plan for double-digit expense growth primarily centered in people. But as a result of that kind of investment and the reliable loan and deposit growth our model has produced, we were able to budget for a strategically advantaged expense to asset ratio near 1.85 percent in 2021.

Our investments in people and culture are the key. Every time we get better, our competitors become more vulnerable to losing their best associates and clients to us.

Attracting and retaining the very best financial professionals ensures Pinnacle’s continued growth and success for the long term. It’s right there in the model that is responsible for all of our growth, both organic and acquisitive:

ASSOCIATES

CLIENTS

SHAREHOLDERS

"If attracting top performing people is the primary driver for rapid growth, and creating a best-in-class culture is the way to make it sustainable, then nothing can be more important than investing in both—especially now."

"Our investments in people and culture are the key. Every time we get better, our competitors become more vulnerable to losing their best associates and clients to us."

2021 wins powered by people and culture

Pinnacle always has been and always will be powered by our people and our culture.

We are successful because of our people.

Just look at what they accomplished in 2021.

*Excluding PPP

All figures as of Dec. 31, 2020 and Dec. 31, 2021.

We are successful because of our culture.

Our people love their work, and it shows.

“this is a great firm where associates want to work.”

“our firm’s culture is special, something you don’t find just anywhere.”

“our firm’s policies give me the flexibility to maintain balance in my life.”

100 Best Companies to Work for in the U.S.

Best Workplace for Women

Best Workplace for Millennials

Best Workplace in Financial Services and Insurance

Best Bank to Work For

We are growing because of our people.

Growth is driven ultimately by happy and successful associates who love their work and pass that excitement on to their clients.

Prominent Hires in 2021

to launch Pinnacle in the National Capital Region

to launch Pinnacle in Birmingham, AL

to launch Pinnacle in Huntsville, AL

to launch Pinnacle’s equipment finance team

to launch a franchise finance team within PNFP Capital Markets

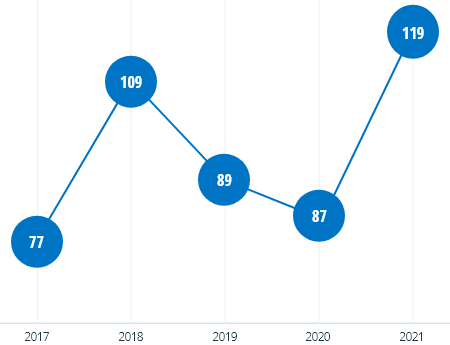

Revenue Producers Added

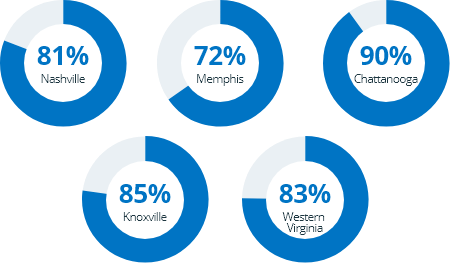

Lead the market for Overall Satisfaction in:

Source: Coalition Greenwich

Overall Satisfaction with Relationship Manager

Source: Coalition Greenwich

*Lead the market in all subcategories: Prompt Follow-up, Proactively Provides Advice, Effectively Coordinates Product Specialists, Frequency of Contact and Understanding Your Industry

We are growing because of our culture, not at the expense of our culture.

What started in Nashville has proven itself successful in several of the hottest markets throughout the Southeast.

Pinnacle won local workplace awards in essentially every market we serve in 2021. In Nashville, we were retired to the Hall of Fame after 10 straight years of Best Place to Work wins.

"We all want the autonomy to do the right thing for our clients and share the wisdom gained through our years in the industry–not just with our clients but also with our coworkers. Pinnacle has taken unhealthy competition out of the equation because every single associate owns stock and almost all take part in our cash incentive program, which means we all benefit when the firm meets its goals. Because of that, associates treat each other with the same heart for service they have for their clients. It is an extraordinary work experience, the best in banking."

— Carolyne Pelton, National Capital regional president

"I've never done a startup like we've done here. I've rehabilitated, restructured and recapitalized many banks. From a basis of building something, starting from scratch, this has been so much fun. It’s hard, but fun, like having a great workout. Where else in the world do you get to work for such a rewarding company, hire people who are your best friends and family and then call that work?"

— Rob Garcia, Atlanta regional president

Our success is sustainable because of our people.

They share goals, a common incentive plan and all have a heart to serve, keeping us focused on what’s right for the long term.

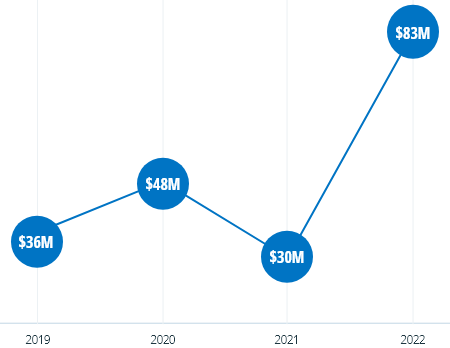

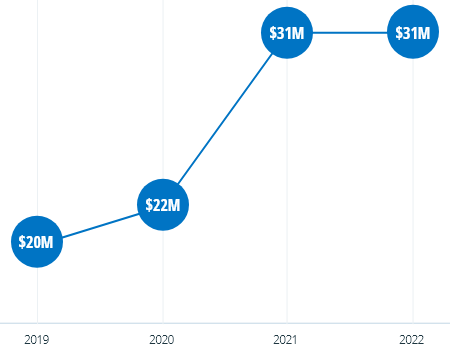

Incentive Payouts

Recurring Equity Grants

Fortress Balance Sheet

Non-performing Assets to Total Loans & ORE

Annualized Net Charge-offs to Average Loans

Past Dues to Total Loans

Our success is sustainable because of our culture.

Pinnacle people genuinely care. We are all obsessed with doing right by our fellow associates and our clients, which leads to lifelong raving fans among both.

Lead Net Promoter Scores in:

Coalition Greenwich Research

High marks and leading positions across many markets for indicators of client perception and loyalty.

- Ease of doing business

- Bank You Could Trust

- Values Long-term Relationships

- Net Promoter Score

- Overall digital experience

*Leads the market.

An obsession with work environment and wowing clients

There’s no better word than “obsession” for our focus on the key aspects of our business model. Every single associate has a laser focus on work environment, culture and client service.

That’s what led us to become one of the largest, strongest banks in the country with one of the best share price performances of any publicly owned bank in the nation since our IPO.

| Since IPO | 10 Year | 5 Year | 3 Year | 1 Year | |

|---|---|---|---|---|---|

| PNFP | 1,810% | 491% | 188% | 107% | 48% |

| KRX | 176% | 153% | 13% | 41% | 33% |

| Out-Performance | 1,634% | 338% | 175% | 66% | 15% |

As of Dec. 31, 2021

Pinnacle’s investment in these vital areas is one of the central reasons for such consistent success in each of our markets, regardless of whether we entered de novo or through an acquisition.

The financial metrics show growth almost across the board over 2020. In third-party client surveys, the bank and our relationship managers (we call them financial advisors) earn high marks consistently in every market measured for categories directly correlated to client satisfaction and loyalty.

Take a closer look at Pinnacle’s successes in each of the markets we serve. PNFP.com/Map

2022 Priorities: Repeat what worked in 2021

Our obsessions will keep driving us onward as we continue to invest meaningfully in our people and our culture.

-

Engage every single associate.

Nothing is more important. This is the fuel that drives our engine. When associates love their work, they give each other and their clients their “discretionary effort,” which is one of the main drivers of our extraordinary performance over the last 22 years. Our 2022 initiatives specifically focused on diversity, equity and inclusion are intended to ensure we excite and engage every single associate every single day. -

Premium pricing for our premium service level.

What happens when we hit high levels of service quality and client satisfaction? Our clients will gladly pay a premium for it. We know we often cost more than many of our competitors, and we’re OK with that because we are worth it. Our associates work hard to earn a premium price, and their clients agree. That’s always been our differentiator, and we believe the gulf has never been wider between what a client gets from our service and that of the nation’s dominant banks. We will seek to continue capitalizing on our culture to drive that difference home so we can use our premium service to try to hold loan yields and minimize the deposit beta in an effort to widen our margins in what we expect will be a rising rate environment. -

Seize market share opportunities around the Southeast.

This happens on three fronts:- Continue to hire great bankers in our existing markets and enable them to move their books of business.

- Extend into new markets with local bankers capable of building a bank of consequence. We have had fabulous de novo opportunities like in Atlanta in 2020 and Huntsville, Birmingham and the Washington, D.C. area in 2021. We’ll continue to seize similar market share take-away opportunities as they arise.

- Attract industry specialists to add greater depth and sophistication to our offerings for large clients.

-

Meet all of our clients’ needs.

We aim for outsized fee growth in wealth management, interchange, mortgage and other areas because we seek to meet every need our clients have. We don’t push products. We lead with advice and seek to have a deep understanding of our clients’ overall finances. You can see it in the Coalition Greenwich surveys, where clients give us high marks for how well their financial advisors understand their needs and where we rank highly against our competitors for the number of financial services our clients choose to purchase from us. -

Maintain strong asset quality

Nothing can demolish earnings like credit losses, so we continue to invest in credit infrastructure, including meaningful investment in system enhancements and support personnel to match our rapid growth in revenue producers.

So 2021 was another phenomenal year of growth at Pinnacle, and we expect more of the same in 2022. Thank you for joining us on this journey and celebrating the wins made possible by our people and distinctive culture.

Onward!